colorado electric vehicle tax rebate

Information session for Marshall fire-impacted residents on March 15 Building Resiliency. Electric vehicles can be charged with a conventional 120-volt household outlet or higher voltage Level 2 and Level 3 charging stations.

Here S Every Electric Vehicle That Currently Qualifies For The Us Federal Tax Credit Electrek

The cost to charge an electric vehicle at public charging stations is pretty straightforward.

. How to be Firewise. The tax credit differs depending on the income tax year and the vehicle category which includes light-duty EVs light-duty electric trucks medium-duty electric trucks and heavy-duty electric trucks. For example the purchase of a light-duty EV in 2020-2021 is 4000.

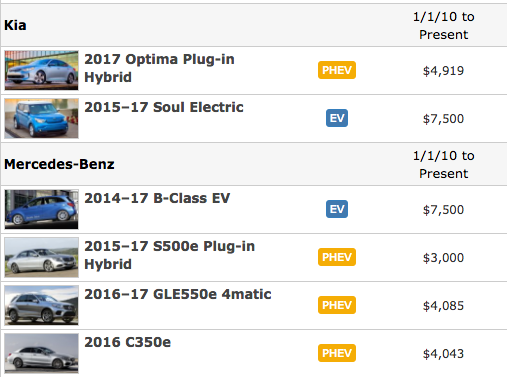

Credit amount depends on the cars battery capacity. The tax credit is available until a manufacturer sells. Maximum Rebate Amounts ZEV Purchase or Lease.

Light duty electric truck. As in you may qualify for up to 7500 in federal tax credit for your electric vehicle. 2500 tax credit for purchase of a new vehicle.

The program would provide a 7500 rebate for new. Plug-In Electric Vehicle PEV Tax Credit. Thats in addition to the federal tax credit and the tandem can reduce the effective out-of.

The federal electric vehicle tax credit up to 7500 is based on the vehicles battery pack not the price. Line 7 is not used to calculate total gross income for the Clean Vehicle Rebate Project. Incentives by Electric Vehicle EV Model.

All of these tax credit amounts will. However theres been a clear problem with the EV segment since 2010. Maintenance Cost for Electric Cars vs Gas.

State EV Tax Rebate. When you buy a used electric vehicle you will miss out on some excellent tax benefits of buying new. Thinking of joining the growing number.

Local and Utility Incentives. Colorado Electric Vehicles Solar and Energy Storage. Light duty passenger vehicle.

Not enough range for the money. If Line 8 Other Income is negative then it will not be included as part of CVRPs income calculation unless an exception applies. A single municipality may receive up to 50 of the total available funds towards ZEVs and EVSE.

The proposed state-level incentive would provide a 2000 rebate for a new electric vehicle and a 500 rebate for at-home charging equipment for a new or used EV. Federal government has initiated a tax credit for plug-in electric vehicles PEVs purchased after December 31 2009. Sign Up for Email Updates.

1500 tax credit for lease of a new vehicle. If you owed 10000 in federal income tax then you. The federal tax credit only reduces your tax.

Colorado and Connecticut offer the highest tax rebate for new EV purchases. Jay Inslee a Democrat has proposed 100 million in funding for a rebate program to help drivers afford electric vehicles. An EVSE rebate is frequently the same as a rebate for an electric vehicle charging station unless the rebate or tax credit program specifies rebates only for certain other items encompassed by EVSE installation for example.

5000 per vehicle 50 miles or greater electric range. Heavy duty electric truck. This virtual event is part of a year-long series on rebuilding.

Credit of 5000 of purchase or conversion and 2500 for a lease of light duty EVs or PHEVs. Medium duty electric truck. The tax credit ranges from 2500 to 7500 for each vehicle based on its battery capacity and gross vehicle weight rating a vehicles maximum weight including cargo and passengers.

Rebates of 2500 are available to eligible customers for the purchase of a qualifying new or used EV or plug-in hybrid. Please visit the Database of State Incentives for Renewables Efficiency website DSIRE for the latest state and federal incentives and rebates. Light duty passenger vehicle.

If a single person purchases two eligible plug-in electric vehicles with tax credits up to 7500 for each vehicle they should be able to claim 15000 in. Across the states the average cost of taxes for a gas car is 545 a year compared to 827 for electric vehicles. EVs titled and registered in Colorado are eligible for a tax credit.

2500 per vehicle 10 to 50 mile electric range Electric Vehicle Supply Equipment EVSE. SW Washington DC 20585 202-586-5000. Click below to find a home charging incentive near you.

If Line 8 on Schedule 1 is negative then the corresponding Statement filed with your. Tax Credits Rebates. Credit amount depends on the cars battery capacity.

For example if you owned a Nissan LEAF and owed say 3500 in income tax this year then that is the federal tax credit you would receive. And if applicable On IRS Form 1040 Schedule 1. EVSE stands for Electric Vehicle Service Equipment and the term includes electric vehicle charging stations.

Xcel Energy offers income qualified customers 5500 rebate for new. The Colorado tax filing and tax payment deadline is April 18 2022If you file a tax extension you can e-File your Taxes until October 15 2022 October 17 2022 without a late filing penaltyHowever if you owe Taxes and dont pay on time you might face late tax payment penalties. Facebook Twitter Youtube Instagram Linkedin.

Sum of lines 1-8. Tax credit for the purchase of a new plug-in electric drive motor vehicle. Its widely known that car shoppers who choose a new electric vehicle can take advantage of a range of tax incentives.

Most importantly theres a 7500 federal income tax credit on most EVs which is highly enticing to many shoppers. Select utilities may offer a solar incentive filed on behalf of the customer Electric Vehicles Solar and Energy Storage. File on time even you cant pay on time as the late filing penalties are higher.

Colorados electric vehicle tax credits have been extended with a phaseout in place for purchases of electric vehicles in the following years. Electric Vehicle vs Gas Car Tax. To deliver on the vision of a large-scale transition of Colorados transportation system to zero emission vehicles - with a long-term goal of 100 of light-duty vehicles being electric and 100 of medium- and heavy-duty vehicles being zero emission - the Colorado Energy Office and its state partners developed the Colorado EV Plan 2020.

Without taking into account incentives and subsidies taxes on electric vehicles are typically more expensive than gas cars. If reducing carbon emissions and eliminating the use of gasoline are your goals buying an electric vehicle is the way to go. I hope this guide helps you get the most out of home charger rebate opportunities.

In California for example people who buy or lease a new electric car can get a 1500 cash rebate. At first glance this credit may sound like a simple flat rate but that is unfortunately not the case. For light-duty medium-duty and heavy-duty electric trucks the credits are 7000 purchase3500 lease 10000 purchase5000 lease and 20000 purchase10000 lease respectively.

Honda Clarity Plug-In Hybrid qualifies for the full EV tax credit because of its battery size. In addition to the federal tax credit of 7500 for buying an EV 45 states have some sort of EV rebate available. The credit amount will begin to drop and eventually completely phase out when the manufacturer sells 200000 units of a particular model.

250000 per facility Hydrogen Fueling Infrastructure. Check out EV incentives here and consider applying for any youve missed.

How Do Electric Car Tax Credits Work Credit Karma

Here S Every Electric Vehicle That Currently Qualifies For The Us Federal Tax Credit Electrek

Tesla Toyota And Honda Criticize 4 500 Tax Credit For Union Made Evs

Tesla Cybertruck Is Already Boosting Sales Keeping Momentum Without Tax Credit Https T Co Ge8cn0mtwh By Fredericlam Tesla Electric Pickup Truck Pickup Trucks

Tesla Drastically Increases Supercharger Prices Around The World Https T Co 3enuhoqhgf By Fredericlambert Electric Car Charging Electric Cars Tesla For Sale

How Do Electric Car Tax Credits Work Kelley Blue Book

Ev Tax Credits Manchin A No On Build Back Better Bill Putting 12 500 Incentive In Doubt Used Electric Cars Tax Credits Sport Utility Vehicle

Tesla Tsla Becomes World S Most Valuable Automaker Hits 1 000 Per Share Tesla Model Tesla Model S Tesla

Electric Vehicle Tax Credits Incentives Rebates By State Clippercreek Incentive Electric Cars Electricity

Here S Every Electric Vehicle That Currently Qualifies For The Us Federal Tax Credit Electrek

The Ev Tax Credit Can Save You Thousands If You Re Rich Enough Grist

Electric Vehicle Tax Credits What You Need To Know Edmunds

All Those Electric Vehicles Pose A Problem For Building Roads Wired

How We Could Put An Ev Charging Station On Every Lamp Post Ev Charging Stations Electric Vehicle Charging Electric Vehicle Charging Station

How The Federal Electric Vehicle Ev Tax Credit Works Evadoption

Here S Every Electric Vehicle That Currently Qualifies For The Us Federal Tax Credit Electrek

Ev Incentives Ev Savings Calculator Pg E

Zero Emission Vehicle Tax Credits Colorado Energy Office

Tax Credit For Electric Cars Tax Credits Irs Taxes Electricity